income tax relief 2017 malaysia

While 419 million vaccines were then being administered daily only 223 percent of people in low-income countries had received at least a first vaccine by September 2022 according to official reports from. These conventions aim to eliminate double taxation of income or gains arising in one territory and paid to residents of another territory.

My Personal Tax Relief For Ya 2018 The Money Magnet

A study by the National Institutes of Health reported that the lifetime per.

. They work by dividing the tax rights each country claims by its domestic laws over the same income and gains. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Double taxation is generally avoided by applying the exemption with progression method ie.

For HUF individual BOI and AOP Rs250000. Foreign tax relief. Section 87A as per the Fiscal Year 2017-18 provides taxpayers with an income tax rebate of Rs.

Statutory personal income tax rates and thresholds. The basic tax exemption limit for the financial year 2017 18 is as follows. Savings taxable income is taxed at the following rates.

Pakistan has executed tax treaties with more than 66 countries see the Withholding taxes section in the Corporate tax summary for a list of countries with which Pakistan has a tax treaty. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. These conventions aim to eliminate double taxation of income or gains arising in one territory and paid to residents of another territory.

No other taxes are imposed on income from petroleum operations. The United Kingdom has one of the largest networks of tax treaties with more than 100 countries. Switzerland has a rather exhaustive network of income tax treaties with currently over 100 jurisdictions.

Taxation of automotive. Tax burden as a share of total price for cigarettes - 2017 Taxation of premium unleaded gasoline per litre - 2019. Among other things PL.

ATI is calculated by taking the taxable income for the tax year as if section 163j does not apply and then adding and subtracting certain amounts from it for the year. As of 2 October 2022 127 billion COVID-19 vaccine doses have been administered worldwide with 679 percent of the global population having received at least one dose. This also means that if the total income of a taxpayer is above Rs.

Tax credits are available with respect to income tax paid to countries with which Brazil has a ratified tax treaty or to countries that would render reciprocal treatment in relation to income tax paid to the Brazilian. A taxpayer can claim relief concerning the. There is no local or provincial income tax applicable to corporates in Sri Lanka.

The allowable deduction for interest expense shall be reduced by an amount equal to 20 of interest income that is subject to final tax if any. If gross income is USD 100000 or less then the individuals total tax will be. In this case the taxpayer may choose to apply the tax regime for non-taxable excess amounts instead of this tax exemption.

US tax reform legislation enacted on 22 December 2017 PL. There are no other local state or provincial. 2500 provided the total income is more than Rs.

All income is considered in order to determine the applicable tax rate but on the. Income Tax - Know about Govt of Indias Income tax guide rules tax efiling online slabs refund deductions exemptions calculations types of taxes FY 2022-23. Thank you Peter.

3 50000 during the Fiscal Year 2017-18 then that individual cannot claim tax deduction under section 87A. Our experienced journalists want to glorify God in what we do. Must contain at least 4 different symbols.

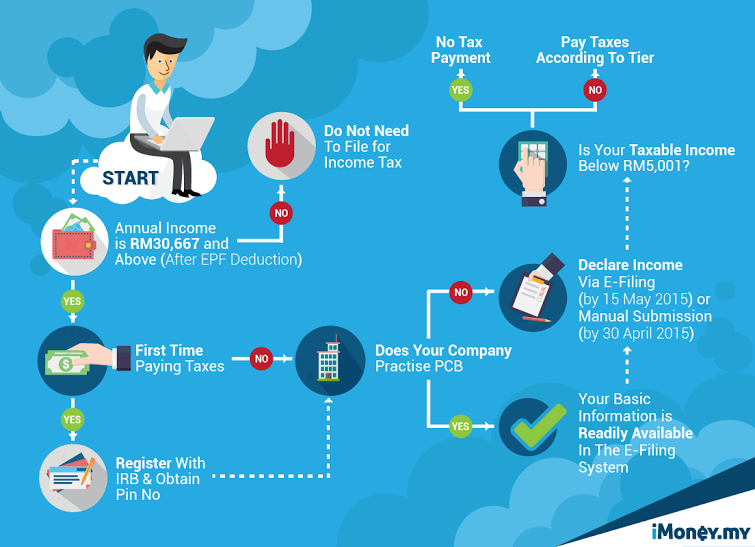

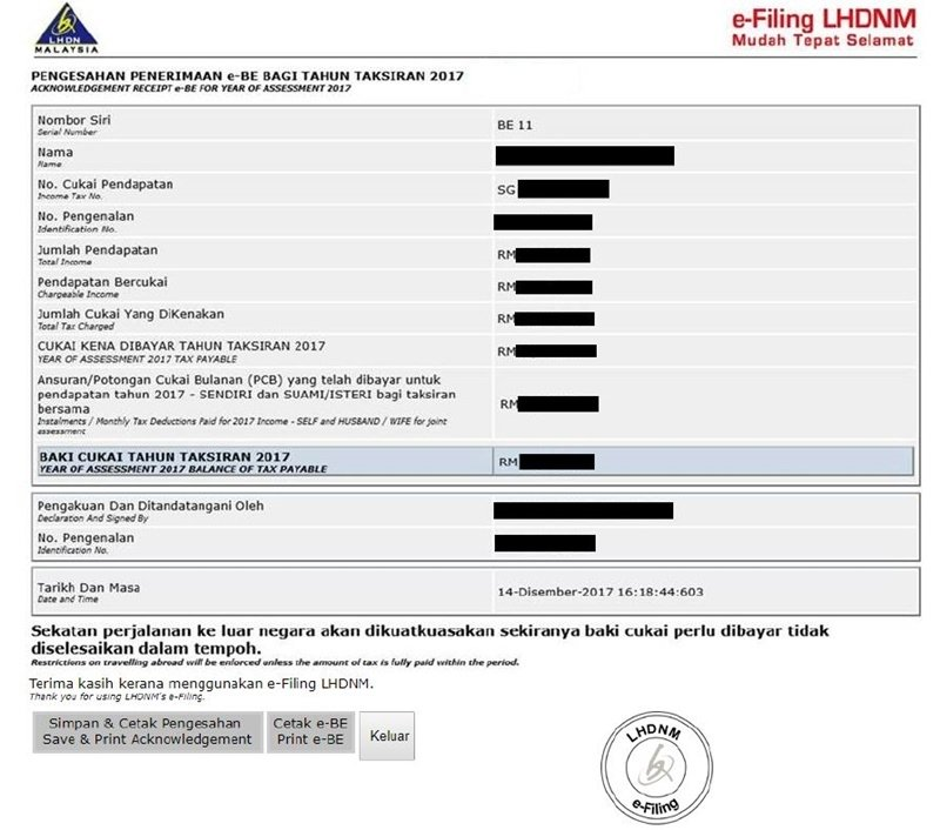

Malaysia adopts a territorial scope of taxation where a tax resident is taxed on income derived from Malaysia and foreign-sourced income remitted to Malaysia. Note that foreign-sourced income of all Malaysian tax residents except for the following subject to conditions to be announced that is received in Malaysia is no longer exempted with. Income tax exemption equivalent to a rate of 60 to 100 of QCE incurred to be utilised against 100 of statutory income and within a period as determined by the Minister applications received by 31 December 2022.

The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. 19 for the first EUR 6000 of taxable income. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. For tax years after 31 December 2019 an individuals total tax will be 95 of ones total tax determined regular tax plus gradual adjustment if gross income exceeds USD 100000. 115-97 moved the United States from a worldwide system of taxation towards a territorial system of taxation.

Most treaties follow in principle the OECD model treaty. Detailed description of foreign tax relief and tax treaties impacting individuals in Brazil Worldwide Tax Summaries. Personal income tax PIT rates.

6 to 30 characters long. Australian-resident individuals who are not temporary residents are subject to Australian tax on their worldwide income with a foreign income tax offset FITO allowed for most foreign income taxes paid to the extent of Australian tax payable on foreign sourced and foreign taxed amounts. The percentage of reduction was adjusted from 33 as a result of the lower CIT of 25 under the CREATE Law.

ASCII characters only characters found on a standard US keyboard. According to a statistical brief by the Healthcare Cost and Utilization Project HCUP there were 357 million hospitalizations in 2016 a significant decrease from the 386 million in 2011. Examples of amounts added back include deductions for interest net operating losses and for tax years beginning before 2022 depreciation amortization and depletion.

21 for the following EUR 6000 to EUR 50000 of taxable income. Yes I will continue to pay US federal income tax filed by our CPA in the US. Thresholds under which there is relief from VATGST registration and collection as well as information on minimum registration periods etc.

Get the latest science news and technology news read tech reviews and more at ABC News. Income tax exemption at a rate of 70 to 100 for a period as determined by the Minister applications received by 31 December 2022. I also understand that I will need to open a personal account at Bangkok Bank and transfer into it 400K from our joint account 2 months before applying for a one year visa extension based on marriage after coming to Thailand on a Non-Immigrant 0 visa to.

Where profits of a non-resident company are remitted in a tax year a remittance tax of 14 of the remittances is payable prior to 1 April 2018 it was at 10. 115-97 permanently reduced the 35 CIT rate on resident corporations to a flat 21 rate for tax years beginning after 31 December 2017. 76 of the population had overnight stays in 2017 each stay lasting an average of 46 days.

Business Income Tax Malaysia Deadlines For 2021

Incometax Handy Guide To Malaysia S Personal Income Tax Filing In 2016 Hype Malaysia

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

More Still Disapprove Than Approve Of 2017 Tax Cuts

Pdf The Relationship Between Tax Evasion And Gst Rate

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Object To My Tax Bill Child Relief Non Singaporean Child Youtube

Malaysia Budget 2017 What Is Lifestyle Tax Relief

What Influences Tax Rates In Sub Saharan Africa Center For Global Development Ideas To Action

Simple Tax Guide For Americans In Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019

Germany Taxing Wages 2021 Oecd Ilibrary

What Influences Tax Rates In Sub Saharan Africa Center For Global Development Ideas To Action

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Malaysia Income Tax Guide 2016

会计人 2017年个人税务减免 Personal Income Tax Relief For 2017 Facebook

Malaysia Personal Income Tax Guide 2020 Ya 2019

0 Response to "income tax relief 2017 malaysia"

Post a Comment